By JP Phillips, Staff Writer, The Times

EAST MARLBOROUGH — Monday night’s budget meeting started with Superintendent John Sanville stating that the proposed $87,093,540 budget correctly reflects the district’s priorities and represents “the lowest weighted tax increase for Unionville Chadds-Ford School District in twenty years.”

EAST MARLBOROUGH — Monday night’s budget meeting started with Superintendent John Sanville stating that the proposed $87,093,540 budget correctly reflects the district’s priorities and represents “the lowest weighted tax increase for Unionville Chadds-Ford School District in twenty years.”

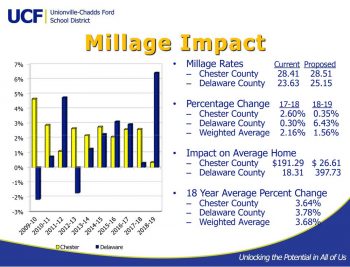

But because of the state-mandated process used by districts who service multiple counties, the overall 1.56% weighted average translates to a .35% increase for Chester County residents, and 6.43% increase for Chadds Ford (the only township in Delaware County that is part of UCFSD).

This is a fact that was revealed during the Jan. 10 special budget meeting when the preliminary budget was approved. It was not discussed thoroughly in public until Monday night.

Distribution of tax burden is described in section 672.1 of the Pennsylvania School Code. Here’s a simplified explanation for the tax percentage variance: The district estimates all revenue expected from state, federal, transfer taxes, interest, tuition, and student fees. Revenue is then subtracted from the projected budget, leaving the balance to be funded by property taxes.

The State Tax Equalization Board (STEB), using two-year-old data, separately calculates the total market value of all Chester and Delaware county properties in the district. That number is compared to the current total assessed value of all properties in the district. The district takes that ratio and applies it to the balance needed to satisfy expenses (based on a 97% collection rate).

According to Director of Business Operations Bob Cochran, 40 of the 500 school districts in Pennsylvania span more than one county. Five of them are in Chester County.

The fact that STEB estimated that total Delaware County property values increased from 19.058% to 19.944% of the UFCSD total generally caused their larger tax increase. Total assessed value—which changes based on new housing, home improvements, and owner-requested assessment reviews—changed at a slower rate for Chadds Ford (.32% versus .58% in Chester County). Cochran noted that sometimes the assessment rate lowers the impact of the market rate change, but not this year.

Cochran showed a chart showing that during the past ten years, Chester County paid a higher percentage six times and Delaware County four times. Last year’s millage rate increase for Chester was 2.6%, while Delaware was .35%.

However, the eighteen-year average millage increase almost balances out, with Chester at 3.64% and Delaware at 3.78%.

As is, the upcoming school tax bill will increase $27 for Chester County residents and $398 for Chadds Ford residents.

It was clear that some board members–especially Gregg Lindner and Carolyn Daniels, who are elected by Chadds Ford and Pennsbury residents–were unhappy with the increase and floated ideas to reduce it. Lindner reminded the Administration and Board that when a budget surplus of $2.2 million (due to health care and special education savings) was uncovered as part of an audit earlier in the school year, the Board went with the Administration’s recommendation and voted 8-1 (Lindner against) to earmark the money for planned building projects.

Lindner said he felt that it would have been better to keep the excess in the general fund, allowing for flexibility to potentially offset situations such as this.

At the Board’s suggestion, the administration will present a new tax estimate using a projected $500,000 savings in healthcare costs projected for this year to decrease taxes for both counties. It will also present a plan that would delay borrowing this upcoming year for building projects, applying $700,000 to the tax burden. If adopted, utilizing these funds could save Chadds Ford residents approximately $50 on average, with more for Chester County.

Whichever plan is agreed to will be voted during next week’s work session. Copies will be made available for public inspection by May 16th, with a final budget vote on June 18th.

The long-term financial outlook is good. All major personnel contracts are agreed upon, healthcare costs are under control, and the fund balance is conservatively estimated at 4.99% of expenses at the end of five years.

Read more details about the district’s finances and tax increase county split in layman’s terms here. Read the whole budget here.

Next Up: Curriculum/Educational Technology Meeting on Monday, May 14 at 4:30, and then the Work Session at 7:30. Both meetings take place in room 14 at the District Office, adjacent to the High School. They will be broadcast live on the UCFSD web site.